There seems to be so much confusion around the Uber IPO, Uber share prices, and Uber service…

The company’s popular around the globe, right? So why isn’t the stock soaring?

Let’s talk about 2019…

This year, a lot of well-known, popular companies had IPOs — Uber, Slack, and Peloton. These companies produce some of the public’s favorite products … but their stocks are complete garbage.

And all of them have underperformed. And traders still ask, “Is now the time to buy?” Let’s look at these ‘hot’ IPOs and Uber share prices to better understand why these stocks aren’t great for small accounts.

Table of Contents

Don’t Fall in Love With a Product

Companies continuously produce new and improved products for the public to love. Once the public bites, media outlets jump on and overhype the companies. The results are huge overvaluations, and it just sets up stocks and traders for disappointment.

Just because a company makes a great product doesn’t mean the company itself is good. There can be a ton of things wrong with a company … But people will overlook huge red flags if they love a specific product. So they look for the right time to jump in.

And as these overvalued companies start to fade, that question keeps popping up: “Is now the time to buy?”

Dip buying on large companies isn’t the same as my dip-buy pattern. It’s challenging to know where the bottom actually is with larger companies. The price could continue to fall for months, like Uber share prices. Let’s check out some recent examples.

Slack Technologies, Inc. (NYSE: WORK)

Since its June IPO, WORK has basically gone straight down. Although it didn’t dump following its IPO, the stock has consistently declined for months. Specifically, it’s dropped roughly 10% every month since the IPO or nearly 50% from its highs.

I can’t tell you how many traders, investors, advisors, and articles I’ve seen calling every one of the dips the bottom. Like when it dropped from $42 to the $30s, according to the financial media, this was a good dip to buy.

And again, when it dipped from $35 to $31, people said it was absolute panic. They thought that was the bottom … only it continued to drop further.

People thought it was an excellent time to buy when WORK dumped to new lows thinking, “Okay … this is down from $42 to $26. This 100% has to be the bottom.”

That mindset is a slippery slope. I always follow rule #1 and cut losses quickly. I don’t hold and hope. Anyone who believed in WORK as a company and bought at the “bottom” lost a lot of money.

Don’t get me wrong, I like Slack’s product. I know a lot of people who like Slack and use it every day. But you can’t judge a stock based on a product alone. You have to understand the company’s fundamentals. And even then, these big companies may not be the best investment. That’s just a small piece of the puzzle.

Uber Technologies, Inc. (NYSE: UBER)

Look at Uber share prices and you’ll see another bad IPO. So why is the stock so bad when so many people around the world use its service?

The stock’s down nearly 50% because they have a lot of issues with their cost structure, growth, management, and company culture. I mean, they have endless problems. Uber’s share prices and stock chart speak volumes.

But if you listen to mainstream media, Uber stock was the greatest buy of 2019. So many pundits and experts hyped UBER as a great buy. People and the media fell in love with the product…

… but they failed to look at all of Uber’s underlying issues. That’s a huge mistake.

Again, I love Uber’s product and will continue to use it. I don’t want to see Uber fail — I’m merely being realistic. Big companies with popular products usually aren’t the best investments.

None of my millionaire and six-figure students made their profits investing in these large, overvalued companies. They used predictable and repeatable patterns like the ones I teach in my Trading Challenge.

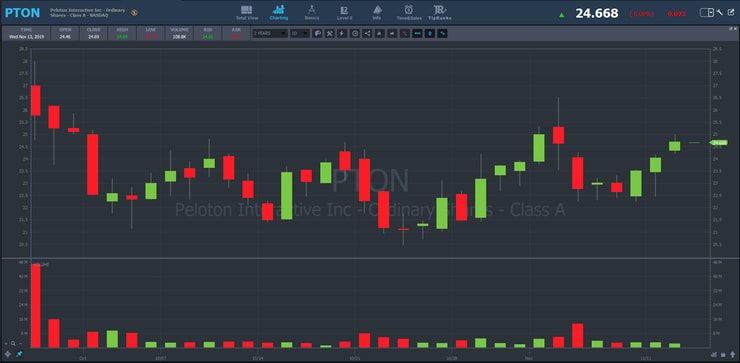

Peloton Interactive, Inc. (NASDAQ: PTON)

Uber and Slack aren’t the only failures. This pattern happens every year with several companies. Peloton, the indoor cycling company, was supposed to be a hot IPO this fall.

But what really happened?

Not much. It dipped a little off its IPO price and has been chopping around. It’s nearly impossible to grow a small account with this price action. That’s why I only trade penny stocks.

Again, don’t confuse the stock and the product. Here’s one last example for you…

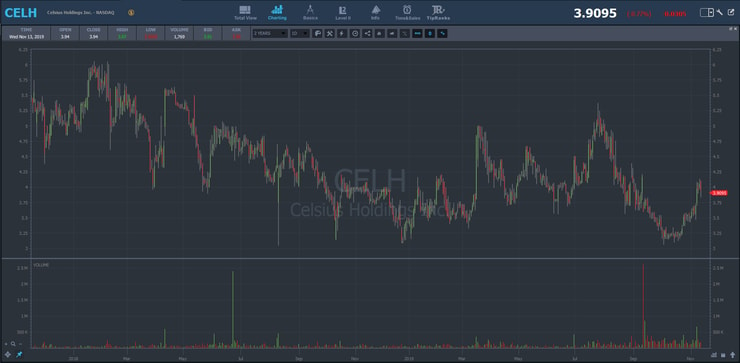

Celsius Holdings, Inc. (NASDAQ: CELH)

I drink Celsius. I think it’s a great pre-workout drink, kinda like a healthy energy drink. A lot of health-conscience fitness professionals recommend their product.

Theoretically, this should do very well. But, over the past two years, CELH has done nothing.

Even some of the world’s wealthiest people invested in Celsius, but it’s failed to perform. Li Ka-Shing, the world’s 30th richest person, is an investor who planned to bring the drink to Asia. Celsius should’ve been a big hit there. For whatever reason, it’s not taking off.

I can’t say this enough. Trading isn’t about the product or the quality of the company.

And if you’re trying to grow a small account, getting 10% growth a year (which is considered good on Wall Street) won’t help you much. What can work for your small account? Day trading penny stocks.

Need a place to start? Check out my free penny stock course here.

Stay Out of Dying Stocks

You can’t hold and hope. Well … you can, but it’s not a strategy, and it doesn’t work.

I hate seeing traders fail. Trust me, I personally love a lot of the products these companies have created. I even use a lot of them, but that’s not enough for me to trade these tickers.

If trading has taught me anything, it’s that the stock market will never value a company based on people’s reaction to the product or service. I know people still think that’s possible because that’s maybe what happened in the market a few decades ago.

Unfortunately, after a 10+ year bull market, you can’t rely solely on a popular product.

For example, if you want a company’s stock to go up, the company will have to come out with new products. Especially with big, multi-billion-dollar companies like Uber or Slack. Also, the product can’t be a fad, and the company also needs to be structurally sound. Even if a company has everything going for them, there’s no guarantee the company’s stock will spike.

I see this trend again and again. It’s challenging for people trying to get into the stock market. Many are busy and think…

“Hey … I just want to invest. I want to invest in what I know!”

That’s a popular adage in the market, “invest in what you know.” But people take it too literally. And sadly, it’s not that simple. People like to oversimplify things.

Popular Products, Good Companies

I’m not saying this strategy never works — sometimes it does. Starbucks is near its highs. Sometimes, people love the product and the stock, like Chipotle.

Chipotle had some food safety issues, and the stock got crushed 50%. But the company is solid, and people continue to love its product. Now it’s right back at all-time highs.

But there’s no discernible pattern with these big companies.

Nike (NYSE: NKE) is near its highs, but you don’t know what will happen next. A lot of people love and use Twitter (NYSE: TWTR) … but it’s been very choppy over the last two years. A huge portion of the business world uses Microsoft (NASDAQ: MSFT), which just hit all-time highs as of this writing. There are just too many factors to consider.

The Reality of Wall Street

You can’t guess a company’s value solely based on personal experience. These simple assumptions don’t make for smart, self-sufficient trading.

Let’s say you pick your 10 favorite products and buy the stocks. Maybe you’d get lucky and buy the next Microsoft. But more times than not, you won’t grow your account that way.

If you look at Uber share prices now — and you bought in on day one — you probably already know this lesson firsthand.

Learn from that experience. Learn from my experience. Focus on how you can be a smarter trader and adapt to the market. That’s exactly what I teach my students in my Trading Challenge. Apply today.

Learn patterns like the ones I explain in my How To Make Millions DVD. These penny stock patterns are far less talked about and less counterintuitive.

What do you think about ‘hot’ IPOs? I love to hear from you!

Leave a reply