The stock market can be highly unpredictable, characterized by sudden shifts from hot to cold that can leave you struggling to plan your next move.

Mastering the ability to navigate through these different types of markets is crucial for every trader.

However, this is easier said than done, and that’s why I am here to help explain three of the hottest stocks I am watching to kick-start this week.

Every morning, I am constantly adjusting my watchlist with stocks that fit my overall strategy…

And just adding stocks to your watchlist is only part of the puzzle; executing these trades is up to you.

So today, I am going to share with you three stocks that may have the biggest potential and why you should be keeping a close eye on them.

Let’s begin…

Why I Am Watching These 3 Stocks

Traders need to understand the importance of a watchlist…

It doesn’t mean you have to or you should trade everything on that list…

Because half of those stocks may not even develop into an ideal setup.

There are days when I am watching more stocks than others, and it just depends on how the overall market is performing.

As we ended last week, there weren’t as many traders to choose from…

But it doesn’t mean that these couldn’t turn into prime opportunities!

So let’s kick things off and break down the first stock I am watching…

Bellerophon Therapeutics, Inc. (NASDAQ: BLPH)

This stock has been a multi-day runner that appears to be nothing but a short squeeze based on its recent news…

And as these short sellers keep getting squeezed out, it makes you wonder how far this could go.

Let’s take a look at the chart.

Here you can see the stock broke through a previous resistant level of roughly $3.50, and then continued higher…

But as the stock attempted to continue its run above the $7.00 mark, twice, it was batted right back down.

I tell my students to be careful and not to chase plays after they had a significant run-up…

And when a play moves up like this and you miss it, you may want to reconsider rethinking your plan of attack.

I encourage everyone here to make sure they understand my 7-Step Penny Stocking Framework inside and out…

That way you can be better prepared for what may happen next.

If you take a look at the yearly chart for BLPH, this could potentially break through a key level…

But I’m not looking to chase, at this point, I will be looking to see if there is a possible panic close to the breakout level back in January.

I will be keeping a close eye on it to see how this stock plays out, but these short sellers are also licking their chops to get in on the action.

The next stock I am about share will sound very familiar to most of you…

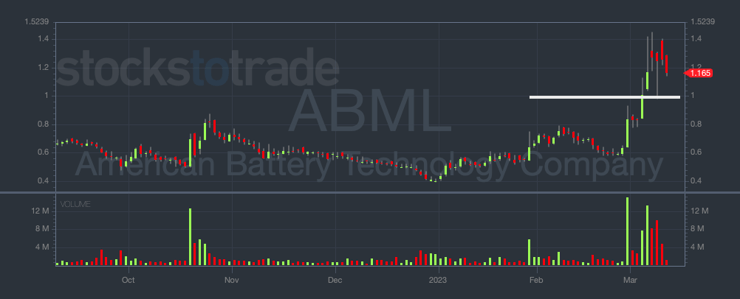

And that stock is American Battery Technology Company (OTC: ABML).

Many of you may question why I would still be watching this stock even though I’ve already traded it.

Simply put, there could be multiple trading opportunities for you to choose from as the stock starts to pull back.

I’ve traded several other OTC plays multiple times, such as Global Tech Industries Group, Inc. (OTC: GTII).

It has to fit the framework and looking at this chart of ABML, it has been holding above the $1.00 mark to the end of the week.

I will be closely watching to see if it can panic again below $1.00 and give us the bounce we saw in the middle of last week.

But remember, if the stock doesn’t bounce make sure you follow my #1 rule as no trade is a guarantee.

The last stock I am watching is Unicycive Therapeutics, Inc. (NASDAQ: UNCY).

This is a stock you don’t want to chase as it was being squeezed higher on Friday.

A stock that is being squeezed higher is why I encourage traders who are just starting off to stay away from short selling…

It can be very dangerous, especially if you get stuck into a trade like this and the stock keeps getting pushed higher and you are forced out of your positions.

But it’s nice if you get in during the ramp-up and catch it before it potentially Supernovas.

Instead of trying to short, or chase UNCY as it was hitting new highs in nearly a year…

I am going to watch to see if there will be a solid panic that has volume.

Let’s take a look at the chart.

Plays like this will eventually panic, but the question is when.

So it’s best to be prepared and this is the mindset you want to have every time you happen to notice a big percent gainer.

Game Plan

Even though we continue to see most OTC spikers fail after a day, I am still putting them on my watchlist after their first big green day…

Because if everything plans out perfectly, you could see a solid panic play the following day.

My watchlist is forever changing, and yours should too!

The panic dip buy is one of my favorite patterns, but you need to always be prepared and know how to spot some other opportunities that may come your way.

Let’s make this week amazing and make sure you continue to focus on big percent gainers.

Keep adding them to your watchlist, and apply everything I’ve been teaching you throughout the week.

I’ll see you here tomorrow!

-Tim

Leave a reply